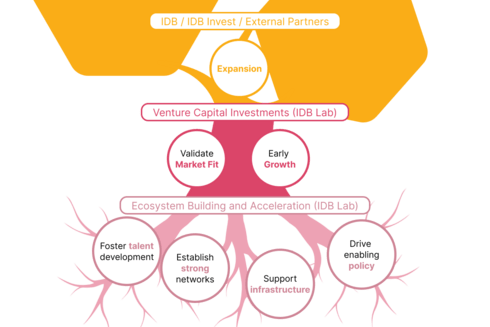

IDB Lab has several products designed to finance early-stage innovation that can be combined and customized to best support clients based on the maturity of their business.

Investments in VC Funds

Apply: https://airtable.com/funds_application

US$2M – US$10M

With this product, IDB Lab seeks to reduce critical barriers to generate a greater impact on development and social inclusion, with particular emphasis on poor and vulnerable populations in Latin America and the Caribbean (LAC). It also seeks to reduce financing gaps in countries, sectors, and business models where there is an unmet demand for investment in early-stage ventures.

IDB Lab has an open call for venture capital funds focusing on Latin America and the Caribbean. For more information, please read the guidelines.

Investment terms:

Fund managers wishing to be considered for an IDB Lab investment must meet the following requirements:

1- Alignment with IDB Lab's investment thesis.

IDB Lab seeks to Invest in VC Funds aligned with at least one of the following three approaches:

Nascent and Emerging Ecosystems: Funds investing primarily in nascent or emerging early-stage ecosystems such as Central America, Caribbean, and selected South America markets -such as Ecuador, Paraguay, Bolivia, and Uruguay (“nascent or emerging ecosystems”).

Regionalization of Funds: Funds with a regional strategy that promotes regional integration and knowledge transfer from more mature markets to emerging markets in LAC while targeting more developed ecosystems.

Sector-Specific Funds: Specializing in high-impact investments and sectors with pronounced structural capital gaps resulting from unmet demands by early-stage entrepreneurs, such as health and biotechnology, technology for education and labor, agricultural or food technology, and climate technology, among others.

2- Geographic focus

The mandate should be to invest at least 80% of the funds in LAC companies.

3- Stage of target investments and minimum fund size

Early-stage investment funds (Pre-seed to Series B) with a minimum size of US$20M. Funds classified under the "Nascent and Emerging Ecosystems" investment thesis require a minimum fund size of US$10M.

4- Team

- Track record, or experience in making and managing early-stage investments.

- Experience and presence in LAC region.

- Full- or significant-time dedication to the fund.

- Complementary skills in management team (financial, operational, entrepreneurial, etc.).

- Expertise in eligible sector-related projects and/or companies.

- Demonstrated ability to source deals from LAC countries, with a relevant pipeline of potential investments.

- Presence of at least one female member as a General Partner and/or in the Investment Committee.

5- Mainstreaming and Impact Measurement

A fund manager with a transformative or impact mission clearly embedded in the fund's investment strategy.

6- Gender and diversity

Strong commitment or intentions to promote gender and diversity at the fund manager and portfolio company levels.

Venture Capital Funds

Equity and quasi-equity investment

Apply: https://airtable.com/equity_application

US$200K – US$500K (Seed Stage); US$1M – US$3M (Series A/B)

With this product, IDB Lab seeks to invest in early-stage, capital-constrained, high-impact companies. Leveraging its position as the only multilateral institution fully dedicated to early-stage innovation ecosystems, IDB Lab can play a catalytic role by investing in businesses that:

(i) have exceptional impact accelerating inclusion, environmental sustainability, and dynamic growth in LAC;

(ii) have strong potential to achieve financial sustainability and business scalability; but

(iii) are not fully satisfied in terms of capital supply from the venture capital industry, given the novelty of the business model, market segment, or geography.

IDB Lab will review all applications received through our application form.

With this focus, we seek to generate transformative, more precise, and vertical impact on the main bottlenecks that limit inclusion related to the most pressing development problems in the region. Our objective with this product is to invest in ambitious entrepreneurs with outstanding business models that align exceptionally with IDB Lab’s areas of work and have a clear potential for systemic transformation in LAC.

IDB Lab always co-invests with experienced partners. IDB Lab invests under market conditions. For more information, please refer to our application guidelines.

Investment Terms

We selectively invest in outstanding companies that align with our priorities through two investment strategies:

1. Pre-Series A to Series B Investment:

- Targeting innovative companies with market traction and a clear pathway to scalability.

- Typical total round size: US$3M – US$30M.

- IDB Lab investment ticket size: US$1M – US$3M.

- Requires strong co-investment participation from qualified institutional investors with a strong VC track record.

2. Seed Strategy (for C&D Countries):

- Designed for early-stage companies based in or targeting nascent innovation ecosystems with low capital availability.

- Focuses on impact-driven companies addressing key development challenges.

- Typical total round size: US$0.5M – US$3M.

- IDB Lab investment ticket size: US$0.2M – US$0.5M.

- Requires strong co-investment participation from qualified institutional investors with a strong VC track record. IDB Lab does not lead rounds.

*C&D Countries: The Bahamas, Barbados, Belize, Bolivia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Nicaragua, Panama, Paraguay, Suriname, Trinidad and Tobago, and Uruguay.

Startups

Debt Products

Apply: https://airtable.com/loans_application

(US$500.000 – US$5.000.000)

At IDB Lab we drive innovation for inclusion, environmental action and productivity

IDB Lab provides debt financing for high-impact startups and innovative companies that are addressing key development challenges in Latin America and the Caribbean.

Target client profile:

- Tech Startups (Early - Growth Stage): with strong business traction, growth, and potential to scale. Recurring revenue is desirable. VC backed, revenues > US $1MM with profitability (EBITDA positive or within 6 months of breakeven). Typically post Series A onwards.

- Innovative businesses: companies and organizations with clear innovation and impact business models. Technical and financial capacity to execute project. Revenues > US $1MM with profitability (positive net income).

Debt financing structure:

- Ticket size: US$ 500,000 – US$ 5,000,000 (smaller tickets focused on C&D, S&I countries)

- Term: 3 – 7 years (average 5 years)

- Grace Period: Up to 24 months for principal (adapted to project needs)

- Currency: USD as default currency (local currency in exceptional cases)

- Interest rate: Market-based interest rates (fixed interest rate as default)

- Use of funds: Working Capital, CAPEX, On-lending, focused on growth

- Equity Features: Venture debt type of structure focused exclusively for high-impact tech startups. Equity features may include debt convertibility options and/or stock warrant options

Startups and innovative companies

Ecosystem Projects

(US$750,000 - US$2M)

Do you have an Ecosystem Project? Share your project here

Under the Ecosystem Building and Acceleration Division (EBA), IDB Lab develops the enabling conditions for LAC entrepreneurial ecosystem to thrive, accelerate growth dynamics, and multiply development impact.

We do so by strategic co-investing, supporting growth capital and spurring enabling policy development, and creating purposeful connections (e.g. between supply and demand) that address existing bottlenecks.

Contributing to removing systemic barriers to early-stage entrepreneurial innovation (e.g. financing, policy), fostering resilient sustainable investment ecosystems with local partners in the driving seat, connecting them with global opportunities, creating jobs, and stimulating entrepreneurship in priority agendas.

Building entrepreneurship ecosystems and nascent industries

Call for proposals to tap into collective creativity