Obtaining a loan is an almost impossible task for more than 1.3 billion adults worldwide. In Mexico, less than 35% of individuals and only 10.5% of businesses have access to formal credit. Financial ignorance —What is credit? How long does it take to get approved? Who will give it to me? How much do I have to pay back?— is compounded by difficulties in accessing services and equipment that can truly meet their specific needs, creating a barrier that perpetuates the shortcomings suffered by the most vulnerable communities.

It was with this in mind that Filiberto Castro and David Hernández decided to form Aviva in Mexico almost three years ago. From the outset, they identified a niche that many fintech startups were ignoring: the use of digital environments and applications in emerging communities, where access to appropriate mobile phone equipment or high-speed internet is scarce.

They understood that they could not build an entirely digital business model, but they also did not want to be a typical bank branch. They needed a hybrid model, as many people in these communities are unfamiliar with both the basic principles of finance and the vocabulary associated with it.

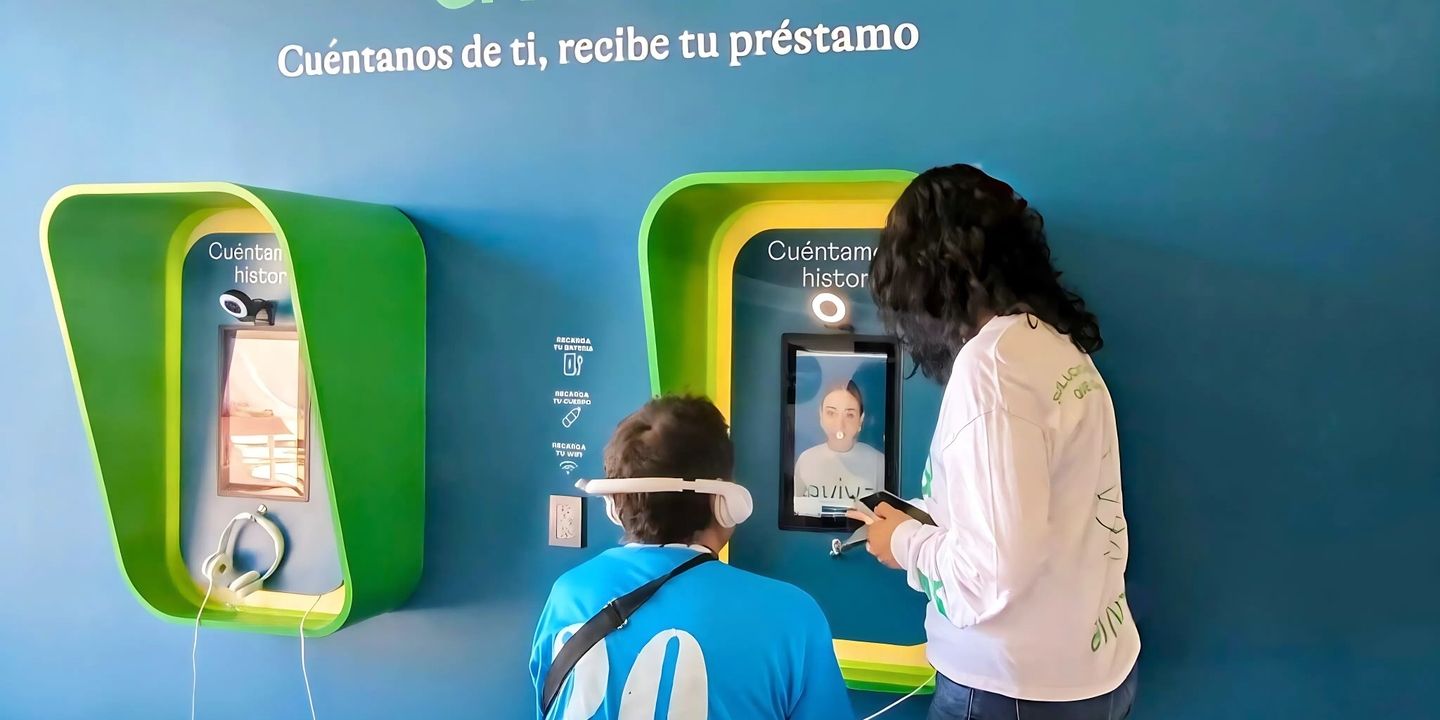

This gave rise to the idea of building kiosks in areas with high foot traffic, equipped with a machine that interacts with a bot that guides the conversation with the user. This business model, which has just received a $1.5 million investment from IDB Lab, was dubbed “phygital,” combining the words “physical” and “digital.”

Artificial Intelligence for Financial Inclusion

To close the gap in access to and information about financial products and the financial situation of the unbanked population, the company has invested heavily in artificial intelligence focused on user needs, as they often cannot rely on traditional credit bureau information.

"We rely on alternative information to evaluate our customers, a more ad hoc analysis for the reality of this market" says Filiberto Castro, Co-CEO and Founder of Aviva.

Supported by computer vision and language processing models, conversations with customers are converted into data for the credit assessment algorithm, and in just seven minutes, the person knows whether their request has been approved. More than 200,000 people have visited one of these kiosks in just 36 months. The growth has been largely due to word of mouth from users, as many of them obtained formal credit for the first time through Aviva. For the company's mission, the location of its kiosks and interest rates are crucial. They do not want to be in large cities. Their focus is on places with a maximum of half a million inhabitants, but the vision is to reach communities of even twenty-five thousand, where the last mile of financial inclusion lies.

The average effective interest rate is 27%, with no origination fees, which makes the credit transparent for the customer. Loans are granted for a maximum of $1,000 and are repaid in weekly installments over two to six months. In comparison, interest rates can reach 500% in the informal credit market.

Support from IDB Lab

Given its focus on inclusion and innovative business model, IDB Lab decided to finance Aviva through our first venture debt operation, a form of financing designed for innovative, fast-growing companies that combines traditional debt features with venture capital elements. Unlike direct investment in shares, it does not immediately dilute the founding partners' stake, but it can include future conversion options.

During the structuring of the operation, we developed indicators and a results matrix that allows us to measure and monitor the positive impact that the initiative is having. Some indicators include portfolio growth and quality, the number of active customers in low-income segments, and the number of people without a previous credit history who are accessing their first formal financing through the company. With sustained growth, Aviva is expected to have at least 150 kiosks by the end of the year.

You can learn more about the types of financing offered by IDB Lab for innovative business models here.